With being in 2022 for a week now, it’s time we start looking at our New Year’s Resolutions! Managing a budget, meeting our financial goals, and improving our financial health is important ambition for many of us. Let’s get tips to budget better this year.

So, how can we prep for financial success in 2022?

As we’ve heard a lot over the last year, 2021 has been full of many unprecedented events. We’re all still facing new challenges. Many people have faced unforeseen financial struggles this year; there are still more than 6.3 million Americans without any or enough work.

What is Budgeting?

Budgeting can be scary for many and it doesn’t have to be! Budgeting has built up a bad rep among many American households, who see it as a way to take all of the fun out of spending money. No more shopping for me. There will be no more eating out at restaurants. Weekend golfing is no longer an option.

A budget’s purpose is not to be used in this manner.

A budget simply shows how much money is coming in and how that money is spent. It’s one of the most important tools in establishing a prosperous financial future because it allows you to make the most of your money.

Every consumer, regardless of economic status or generation, can benefit from creating and managing a budget. A budget provides people with a sense of control over their finances. Consider a budget to be a financial foundation. Each person’s foundation will be unique, just as each person’s financial situation will be unique. Meaning their way of budgeting will be unique to them!

Tips to Budget Better: Creating Your Budget

There is no magic budgeting trick to mitigate the losses we’ve encountered this year. So, however, you choose to manage your personal finances, our number one tip for success in 2022 is to be kind to yourself and your neighbors.

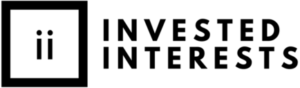

Here are some of our best budget approaches for 2022:

1. Essentials-Only Budget

If you’re under financial strain this year, you’re not alone. If you’ve lost your job, had a medical emergency, or been dealt with other unforeseen expenses, you might be looking to cut your spending as much as possible. An essentials-only budget can help you reduce your expense for a short time while you get back on your feet.

2. Intentional Spending

Intentional Spending is the practice of money mindfulness. This can help you cut costs and align your finances and your values. To start spending intentionally, create a list of your personal values and financial goals. Then, go through your finances to see where your spending doesn’t match your intentions.

An intentional budget is not a joyless one. Including expenses that motivate you and uphold your values can keep your budget realistic. If a cup of coffee from your favorite local cafe brightens your morning, add it to your budget.

3. 50/30/20

This budgeting rule allocates 50% of your finances to your needs, 30% to your wants, and 20% to future you. First, your needs are things like bills, groceries, housing, or transportation. Next, wants are things like going out with your friends or your favorite streaming services. Finally, future you include debt payments, savings, and investing.

This budget can help you build a healthy relationship with money without spreadsheets calculating every penny you spend. You can budge the rule a little to help meet your needs. For instance, maybe your needs move up to 60%, making your budget more of a 60/25/15. That’s ok! Or, for you, maybe Spotify is a need to get work done.

Overall, this budget is meant to help you build your personal finances for future you. Money can seem scary, but it doesn’t have to with easy budgeting tricks and tips.

4. One-Number Approach

For budget beginners, this easy approach can help you understand your finances. Start with your monthly take-home pay. Then, subtract all your fixed expenses including housing, subscriptions, savings/investments, and more. Finally, take that number and divide it by 4.3 (the average number of weeks in a month. This is your one number — all you have to do to stay on budget is keep your weekly expenses under that number.

5. Blogs, Podcasts, Books, and More

Maybe you already have a budget in place but are still looking for money-saving or investment advice. Where do you go?

For a variety of budgeting ideas, check out a blog like Mr. Money Mustache. Mr. Money Mustache helps you get your finances in order with inspiration, tips, and tricks for anyone getting their finances together. If you’re in search of a more focused discussion on personal finance, opt for a book like The Index Card: Why Personal Finance Doesn’t Have to Be Complicated.

Social media is another great place for resources on budgets, investments, and finance. Check out Invested Interests on Instagram. Our #FinanceFriday posts will provide your feed with weekly financial updates and tips.

Ready to Budget Better this Year?

Whatever combination of budgeting tips you use, make sure your finances work for both presents you and future you. By building up your savings account and investing now, you can help alleviate future financial strains.

In addition, opting for socially responsible investments can help ensure your dollars support you and your values. If you are ready to start your ethical investing journey, call us or send us an email! We’re here to help answer your investing questions and get you started with an investment portfolio that works for you. Reach out to us at: https://investedinterests.com/contact-us/