What happens to your 401(k) when you quit or lose your job?

Have you ever wondered what happens to your 401(k) when you quit or lose your job? While 401(k) funds may not be a tangible asset,

Have you ever wondered what happens to your 401(k) when you quit or lose your job? While 401(k) funds may not be a tangible asset,

You’ve probably heard the term “Mutual Fund” before. Maybe it was in passing at work or around the dinner table with your in-laws, but there

This topic hits a little different for us. Investing in Peace is so closely related to the story of Invested Interests. Whether you’re talking about

Earth to readers! As a global pandemic is in full effect, it is essential not to forget about another worldwide crisis that has been unfolding

Ah yes, we’ve found ourselves in that post-election season bliss. You know what I’m talking about, it’s that sweet moment when sunlight finally starts peeking

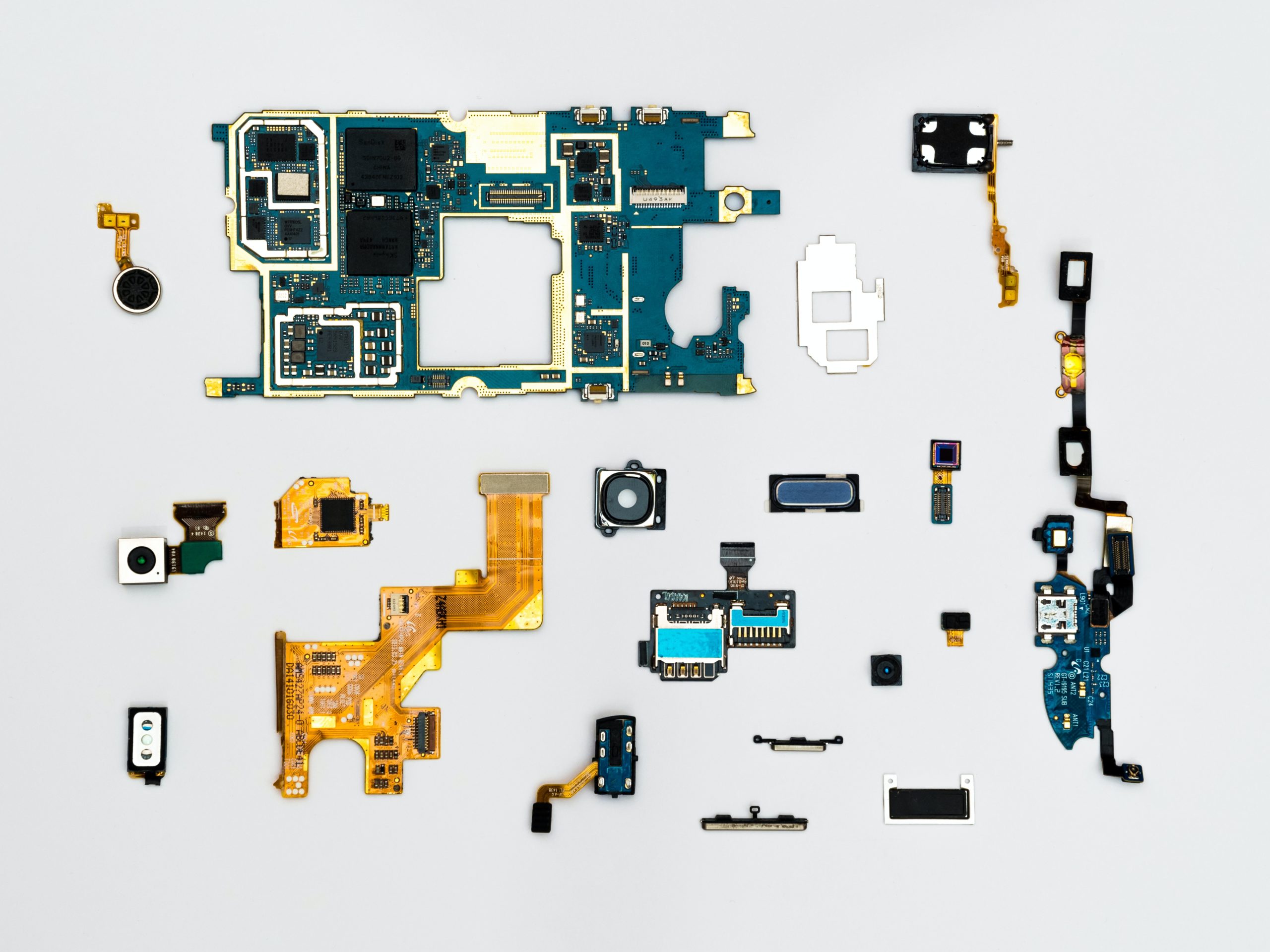

Long live the machines! Yeah, that doesn’t sound quite right to me either. Recent technology has provided us with modern conveniences like voice-activated AI (think Alexa