Impact investing may be the new “it” thing to do in the world of investing, but in truth, impact investing dates back to the 1960s. At that time, the focus was on women’s rights, civil rights, and anti-war agendas. Sadly, many of those same causes are still at the forefront of impact investing today.

By definition, impact investing or socially responsible investing (SRI) refers to the practice of utilizing an investing strategy that considers both financial return AND a socially-conscious effort to promote positive change. Impact investing is once again making a big splash in the investing world with social causes having a great platform and following than ever before – due largely to social media. Individuals use this platform to align themselves with their personal values, and this translates into their investment decisions.

The Start of Invested Interests

Invested Interests began back in 2003 working with the Sudan Divestment Task Force. The Task Force led universities, endowments, and individual investors to divest from companies supporting the Sudan regime accused of genocide against its own people in the Darfur region.

We worked with the Task Force to make their targeted divestment list into a portfolio for investors. Divesting in specific companies like Schlumberger Limited and Petro China, had a significant impact on the region.

Does it work?

The initiative started in 2003. By 2008:

- 27 States had adopted divestment policies from Sudan.

- The United States government approved the Sudan Accountability and Divestment Act which prohibited federal contracts with companies that operate in Sudan’s oil, power, mineral and military sectors.

- 61 Universities have adopted Sudan divestment policies allowing their schools to make conscionable, genocide-free investments.

- 13 Companies ceased operations in Sudan or significantly changed their behavior in the country. These include Siemens, Rolls Royce, Petrofac, and many others.

And, while human rights still remains a pressing issue in Sudan, significant progress has been made for the rights of the individuals there.

Make money. And make an impact.

As we’ve mentioned, impact investing is an investment strategy that considers both financial returns and social responsibility.

In other words, it’ isn’t just the right thing to do, it’s the smart thing to do.

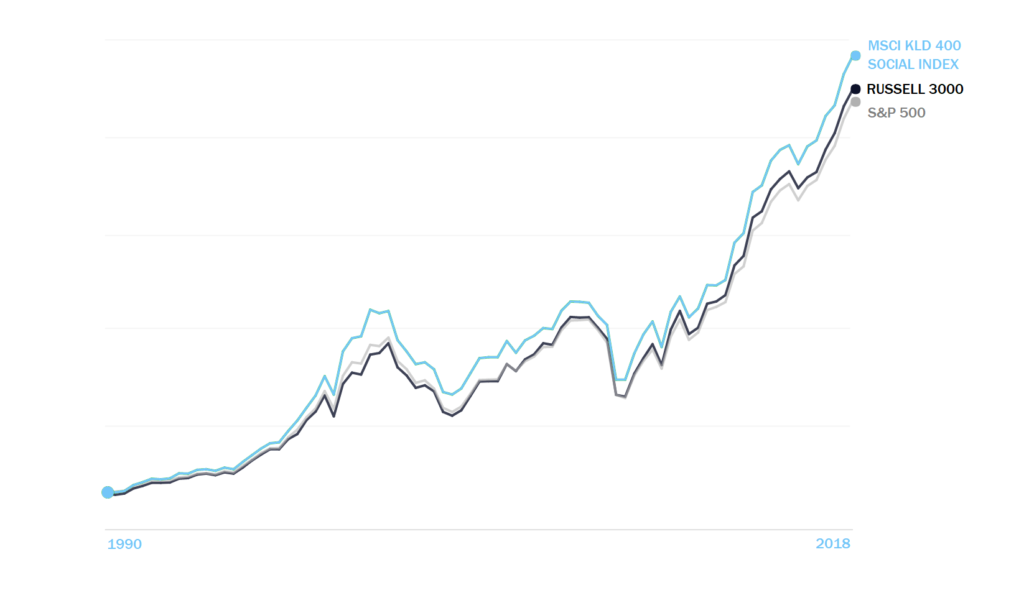

While investments are never guaranteed, the MSCI KLD Index is the socially responsible version of the S&P 500 Index. It has outperformed traditional investments over the last 20 years.

Change has to start somewhere. The most effective way to get corporations to make a change is to move money away from the bad and into the hands of companies that are doing the right thing and making an impact.

Want to learn more about impact investing and how you use your money for good? Reach out to us @ info@investedinterests.com