At Invested Interests, we are all about impact investing. But that raises the question, what truly is “impact investing”?

By definition, impact investing refers to investments, “made into companies with the intention to generate a measurable, beneficial, social or environmental impact alongside a financial return.” There are two primary reasons that you might choose impact investing. One, you are conscious about how your money impacts the world, and two, you want to use your dollars to support social change.

Impact investing is often used as a catch-all term to describe all socially responsible investments. In reality, there is a multitude of terminology under that “impact investing” umbrella. Let’s break them down.

Impact Investing Acronyms and Words to Know

What is Impact Investing (II)?

Though it may not technically have an “ii” acronym by everyone else’s standards, it does seem to fit here at Invested Interests. Coincidentally, those are our two favorite letters as well. Impact investing refers to investing in funds, companies, or organizations in order to make a social impact as well as a financial one. There are many types of social impacts and social divestments (choosing to not invest in a cause) that investors can choose from including investing in the environment, human rights and diversity, and peace.

What is Socially Responsible Investing (SRI)?

Often used interchangeably with impact investing, socially responsible investing involves utilizing your assets along with other socially conscious investors to promote positive change. The acronym can also be used to suggest Sustainable – Responsible – Impact incorporating the desires of investors.

What is Responsible Investing (RI)?

This concept has somewhat shifted with the investment landscape in recent years. Previously only open to large and wealthy investors, responsible investment opportunities gave growth in both sophistication and numbers. Investing responsibly is no longer associated with making only smart investment choices, but making investment choices that are responsible in terms of sustainability and positive impact.

What is Environmental, Social, and Governance (ESG)?

The acronym ESG is used far more than its full name which standards for a set of criteria that are used to screen companies for sustainable practices and ethical implications. The three main types of social criteria impact investors focus on are typically related to environmental, social, and corporate governance issues.

What is Corporate Social Responsibility (CSR)?

Corporate social responsibility (CSR) is a type of business self-regulation that both small and large companies participate in to judge their impact on the environment around them. A broad term, CSR, differs vastly based on the industry but can include such issues as increasing volunteer efforts, monitoring and evaluating internal HR practices, and reducing carbon footprints.

What is the Global Impact Investing Rating System (GIIRS)?

Pronounced “Gears”, the GIIRS is a rating system applied to both companies and funds that allows impact investors and fund managers to evaluate social impact.

What can you do with impact investments?

Now that you have all the terms, it is time to get down to the nitty-gritty. What exactly can you do with impact investing? Luckily, you have the power to do just about anything. Whether that is investing in companies that promote peace or take actions to support the environment, you have the power to put your money where you want.

At Invested Interests, we make it even easier for you. We help you build your portfolio so you can feel good about where your money is going. Here are three of our portfolio options to give you an idea of what we do.

Impact Investing Portfolio Options

-

Peace

Our Peace portfolio invests in companies that do not support governments or regimes promoting violence and avoids companies directly involved in armed conflicts. This portfolio avoids guns and weapons dealers and manufacturers, companies working with regimes in armed conflict, and companies with known military contracts or war profiteering.

-

Human Rights & Diversity

Our Human Rights & Diversity portfolio invests in companies that promote fair and equitable working conditions, companies with diverse boards and workforces, companies that offer equal pay for equal work, and companies that care about the safety and well-being of communities. This portfolio avoids oppressive regimes, companies with little or no workplace diversity, and companies that have had diversity-related controversies, like sexual harassment or racism.

-

Environment

Our Environment portfolio invests in green companies, alternative and renewable energy companies, and companies promoting sustainability. It avoids oil and fossil fuel companies, companies that are not eco-friendly, and nuclear power companies.

We partner with the best socially responsible mutual funds available that invest in companies solving the world’s biggest problems. These funds will only invest in companies that meet certain criteria. For example, having high sustainability and/or ESG performance. Whether you are a seasoned investor or one looking to just dip your feet in, we have something for you.

Will you have to sacrifice returns with Impact Investing?

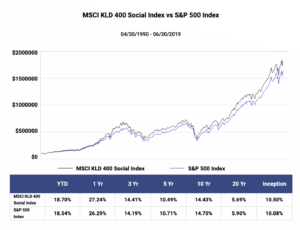

That is the best part! Sustainable investing has seen a 14-fold increase since 1995. Impact investing is the biggest it has ever been, with evidence to show it is only going to increase. Research shows that social responsibility funds have done better in the last 20 years than traditional investment funds! The MSCI KLD 400 Social Index is composed of companies with high ESG ratings and avoids companies incompatible with specific values-based criteria. This index, which is the oldest ESG index in the US, has shown that ESG can create added value – by outperforming the S&P 500 for the last 25 years. Think of the MSCI KLD 400 as the socially responsible screened version of the S&P 500.

How Do You Start Impact Investing?

With impact investing continuing to show promising results, now is the time to hop on the bandwagon. As previously mentioned, Invested Interests is here to help you take your next steps on your impact investing journey. Managing your own investments may not be right for you, and perhaps you do not want to work with a big company either. Companies, like Invested Interests, are making it easier for people to invest with their values, and not only that, but our only focus is impact investing, which gives us the opportunity to give our clients all the attention they deserve.

Anyone can make a difference with their investment decisions. Whether you are a pro-investor or someone new to the game, we would love to help you! Reach out to our team here to get started with Invested Interests.